Federal Incentives: Tax Credits & Rebates

What You Need to Know

We want to help you take advantage of new incentives that could affect how you replace your heating and cooling systems. As part of the Inflation Reduction Act of 2022, you can now take advantage of enhanced tax incentives and a new state-administered consumer rebate program that were designed to encourage you to upgrade your HVAC systems with heat pumps and high-efficiency air conditioners and furnaces. This section provides important information on the Energy Efficient Home Improvement Federal Tax Credit (Tax Section 25C) and the High Efficiency Electric Home Rebate Program.

Energy Efficient Home Improvement Federal Tax Credit EEHI (Tax Section 25C)

Originally effective January 1, 2023, with updates for 2025 installations effective January 1, 2025, the Energy Efficient Home Improvement Federal Tax Credit (EEHI) gives you a tax credit equal to 30% of equipment and installation costs for the highest efficiency tier products, up to $600 for qualified air conditioners and $600 for qualified furnaces, as well as up to $2,000 for qualified heat pumps. Here are a few things you should know about the EEHI:

Effective January 1, 2023, through December 31, 2025

No lifetime tax credit cap

Not limited to primary residences

No income requirements

Increases the percentage of the credit from 10% to 30% of equipment and installation cost

Annual $1,200 nonrefundable tax credit for eligible HVAC systems, insulation and air sealing; and a $2,000 tax credit for eligible heat pumps

Tax credit offsets federal taxes owed

Qualifications

Product Qualifications:

2023–2024 Installs

Gas Furnaces: ≥ 97% AFUE

Product Qualifications:

2025 Installs

Gas Furnaces: ≥ 97% AFUE

Required Qualified Manufacturer ID (QMID): K3A8

Learn More

Qualifying Heating & Cooling Products

DOWNLOAD A FEDERAL TAX CREDIT MANUFACTURER CERTIFICATION FORM| 2023–2024 Installations Download Now |

2025 Installations Download Now |

HIGH EFFICIENCY ELECTRIC HOME REBATE PROGRAM

The Electric Home Rebate Program offers consumer rebates on qualifying heat pumps, panel replacements and electrical wiring. Here are a few things you should know about the Electric Home Rebate Program:

Available Tax Rebates Based on Income

< 80% of Area Median Income

80–150% of Area Median Income

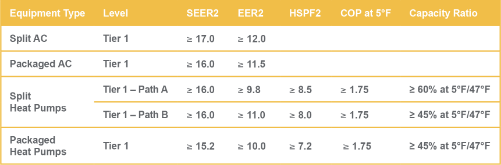

Qualifying ENERGY STAR® Certified Heat Pumps*

Split System Heat Pumps

|

*These models qualify only when installed as part of a matched system combination that meets current ENERGY STAR® criteria.

Since this program is at the state level, the DOE has created a map to help contractors, distributors and homeowners easily see each state’s current application status.

As stated previously, the rebate program is restricted to residents who meet certain income criteria—and it will be up to each state to finalize the income verification process.

The DOE has recently provided updated information that gives states options to verify eligibility:

- Income verification is required before accessing a rebate

- Consumers can self-attest income eligibility before accessing a rebate

- State plans will include criteria to approve contractor participation in the state rebate program

- States will take varied approaches to establishing qualified contractor lists

TECH Clean California Program

Contractors enrolled in TECH Clean California and those new to the initiative can become certified to offer single-family HEEHRA rebates.

Frequently Asked Questions

Q: Is the $2,000 tax credit for a heat pump system conditioned on replacing a central air conditioner and furnace?

A: No, replacement systems are eligible, and consumers who choose to replace an existing heat pump with a new heat pump can claim the credit.

Q: Can a customer claim both an Energy Efficient Home Improvement tax credit and a rebate through the High Efficiency Electric Home Rebate Program?

A: There is no statutory prohibition on a customer claiming both a credit and rebate, but the US Treasury Department must issue final implementing rules on incentive layering.

Q: How can I determine my eligibility to access a rebate through the High Efficiency Electric Home Rebate Program?

A: The US Department of Energy State & Community Energy Programs Office provides consumers with additional information on the High Efficiency Electric Home Rebate Program, including income qualification rules.

Find Local Incentives

Additional state, local and utility rebates may be available in your area. For more information, visit our FAQ page.

Maximize Your Savings

Get our Downloadable IRA Reference Guide to discover how you can take advantage of tax incentives.